This post is not financial advice.

2025 Oil & Gas Market Overview: Stability Amidst Uncertainty

Brent Crude’s Delicate Equilibrium

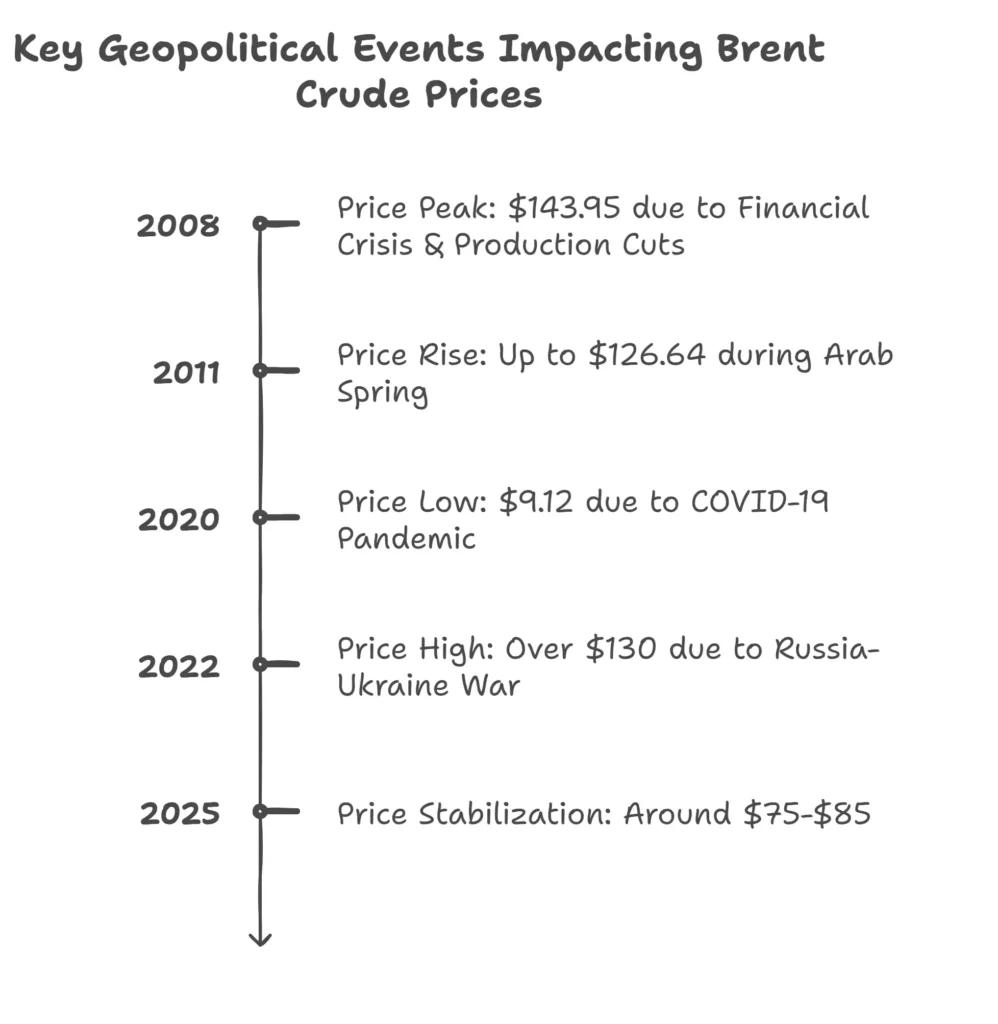

As of March 2025, Brent crude prices hover around $74 per barrel (EIA Short-Term Energy Outlook), a stabilization driven by OPEC+ supply discipline and steady demand from non-OECD nations like India and Nigeria. However, this equilibrium is fragile. Geopolitical flashpoints—such as renewed tensions in the Strait of Hormuz or Russia’s Arctic LNG ambitions—could disrupt supply chains overnight. For investors eyeing Oil and Gas Investment 2025, this delicate balance underscores the need for strategic agility and risk-aware portfolio allocation.

- Oversupply Risks: Non-OPEC+ producers, including the U.S. and Brazil, are ramping up output, potentially creating a glut if global demand softens (Wood Mackenzie).

- Recession Resilience: Integrated majors like ExxonMobil and Shell have historically outperformed during downturns due to diversified operations, from refining to petrochemicals.

Investment Opportunities: Dividends, Undervaluation, and Strategic Pivots

High-Yield Dividends: A Beacon for Risk-Tolerant Investors

Oil and Gas Investment 2025

Oil majors continue to reward shareholders despite market turbulence:

- Saudi Aramco: Offers an 8–10% dividend yield, leveraging its low production costs ($3/barrel) and dominance in Asian markets.

- Chevron: Maintains a 3.8% yield, supported by LNG exports and a $50/barrel breakeven cost, the lowest among peers.

ESG Divestment: Contrarian Opportunities

ESG-driven sell-offs have depressed valuations, creating entry points for investors. For instance, ExxonMobil’s P/E ratio of 8.5x is 15% below its 10-year average (Morningstar). Companies balancing fossil fuels with low-carbon investments—like BP’s wind farms or TotalEnergies’ solar projects—are attracting ESG-conscious capital.

Strategic Approaches: Diversification and Innovation

ETFs: Mitigating Volatility

Exchange-traded funds (ETFs) blend stability and sector exposure:

- Energy Select Sector SPDR Fund (XLE): Tracks U.S. giants like ExxonMobil and Chevron.

- iShares Global Energy ETF (IXC): Includes transitional players like Equinor and Ørsted.

Corporate Discipline: The New Imperative

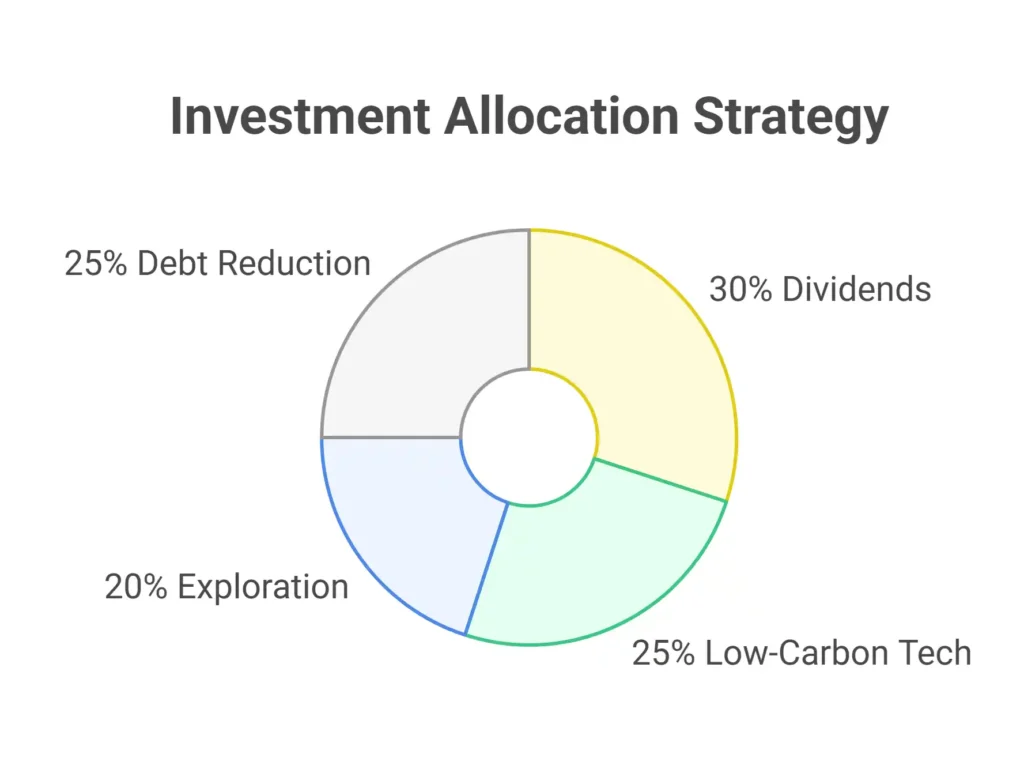

As noted by Wood Mackenzie, capital allocation in 2025 demands precision. Companies like ConocoPhillips prioritize high-return projects (e.g., Permian Basin drilling) while divesting non-core assets.

Risks & Challenges: Geopolitics, Regulation, and Black Swans

Geopolitical Instability: Supply Chains Under Siege

- Russia-Ukraine Fallout: Sanctions rerouted 40% of Russian crude to India and China, straining tanker capacity (EIA).

- Red Sea Disruptions: Houthi attacks increased insurance premiums by 25%, squeezing margins for shippers like Maersk.

Regulatory Headwinds: The Cost of Decarbonization

The EU’s Carbon Border Adjustment Mechanism (CBAM) could add $5–10/barrel to production costs by 2030. Meanwhile, the U.S. Inflation Reduction Act incentivizes green hydrogen projects.

Black Swan Events: Preparing for the Unpredictable

Economist Cunningham warns that crises—like an OPEC+ collapse or Gulf of Mexico hurricanes—could send Brent crude soaring to $120/barrel or crashing below $60.

Long-Term Outlook: Peak Demand and Energy Security

The Looming Peak Oil Era

The IEA forecasts global oil demand peaking by 2030, but developing nations will drive 70% of consumption growth through 2040.

Low-Carbon Transition: A Strategic Imperative

- Chevron’s Hydrogen Ventures: Targets 10% of global hydrogen demand by 2030.

- ExxonMobil’s CCS Projects: Aims to capture 5 million metric tons of CO2 annually by 2027.

Actionable Recommendations for 2025 Portfolios

Allocate Strategically: 10–15% to Oil & Gas

- Chevron (CVX): Resilient dividends and hydrogen projects.

- Energy ETFs (XLE, IXC): Reduce single-stock risk.

Complement with Renewables and Hedges

- iShares Global Clean Energy ETF (ICLN): Balances exposure with leaders like NextEra Energy.

- Gold: A 5–10% allocation mitigates volatility.

Final Thoughts: Navigating the 2025 Oil and Gas Landscape

The oil and gas sector in 2025 presents a paradox: short-term opportunities anchored in stable dividends and undervalued equities clash with long-term uncertainties driven by energy transition pressures and geopolitical volatility. For maritime and energy professionals, success hinges on three pillars:

- Strategic Balance: Leverage high-yield stocks (e.g., Chevron, Saudi Aramco) and ETFs (XLE, IXC) for near-term returns while allocating to renewables (ICLN) as a hedge against demand erosion.

- Geopolitical Vigilance: Monitor hotspots like the Red Sea and OPEC+ decisions, which could trigger price swings between $60–$120/barrel.

- Adaptive Innovation: Back companies bridging fossil fuels and low-carbon tech, such as ExxonMobil’s CCS projects or TotalEnergies’ wind investments.

The industry’s resilience lies in its ability to serve both developing nations’ energy needs and global decarbonization goals. For a deeper dive into power dynamics shaping this balance, explore Who Rules Oil and Gas in 2025?.

In 2025, agility—not allegiance to tradition—will define winning strategies.

Q&A: Oil and Gas Investment Insights for 2025

1. What stocks will boom in 2025?

Answer:

Stocks positioned for growth include:

- ExxonMobil (XOM): Strong earnings ($33.7B in 2024) and carbon capture projects.

- Chevron (CVX): Low breakeven costs ($50/barrel) and hydrogen investments.

- Saudi Aramco: 8–10% dividend yield and dominance in Asian markets.

2. Why are oil stocks falling?

Answer:

Declines are driven by:

- ESG Divestment: Investors shifting capital to renewables, depressing valuations.

- Regulatory Risks: Carbon taxes and drilling bans increasing operational costs.

3. Do oil stocks do well in a recession?

Answer:

Integrated majors like ExxonMobil and Shell often outperform due to diversified operations (refining, petrochemicals) and stable dividends.

4. Is there a future in oil and gas?

Answer:

Yes, but with caveats:

- Short-Term: Demand remains robust in developing nations (India, Africa).

- Long-Term: Companies must adapt via low-carbon tech (e.g., Chevron’s hydrogen, Exxon’s CCS).

6. Which energy company is best to invest in?

Answer:

- Chevron (CVX): Resilient dividends, low debt, and transitional projects.

- ExxonMobil (XOM): Undervalued with CCS innovation.

7. What is the best oil and gas ETF?

Answer:

- Energy Select Sector SPDR Fund (XLE): Tracks U.S. giants (0.10% expense ratio).

- iShares Global Energy ETF (IXC): Global exposure, including renewables.

8. Will oil prices go up?

Answer:

Prices could swing between $60–$120/barrel depending on:

- OPEC+ Decisions: Supply cuts or hikes.

- Geopolitical Conflicts: Red Sea disruptions, Russia-Ukraine fallout.

9. Is Exxon a good stock to buy?

Answer:

Yes, for:

- Dividend Stability: Supported by Guyana reserves.

- CCS Leadership: Capturing 5 million metric tons of CO2 annually by 2027.

10. Should I invest in gold?

Answer:

Allocate 5–10% to gold as a hedge against oil price volatility and black swan events.

11. What is the biggest oil company in the world?

Answer:

Saudi Aramco dominates with unmatched production scale and a $3/barrel production cost.

12. What stock to invest in today?Answer:

Prioritize:

- Chevron (CVX): Balanced risk-reward profile.

- Energy ETFs (XLE, IXC): Diversified exposure.

Leave a Reply