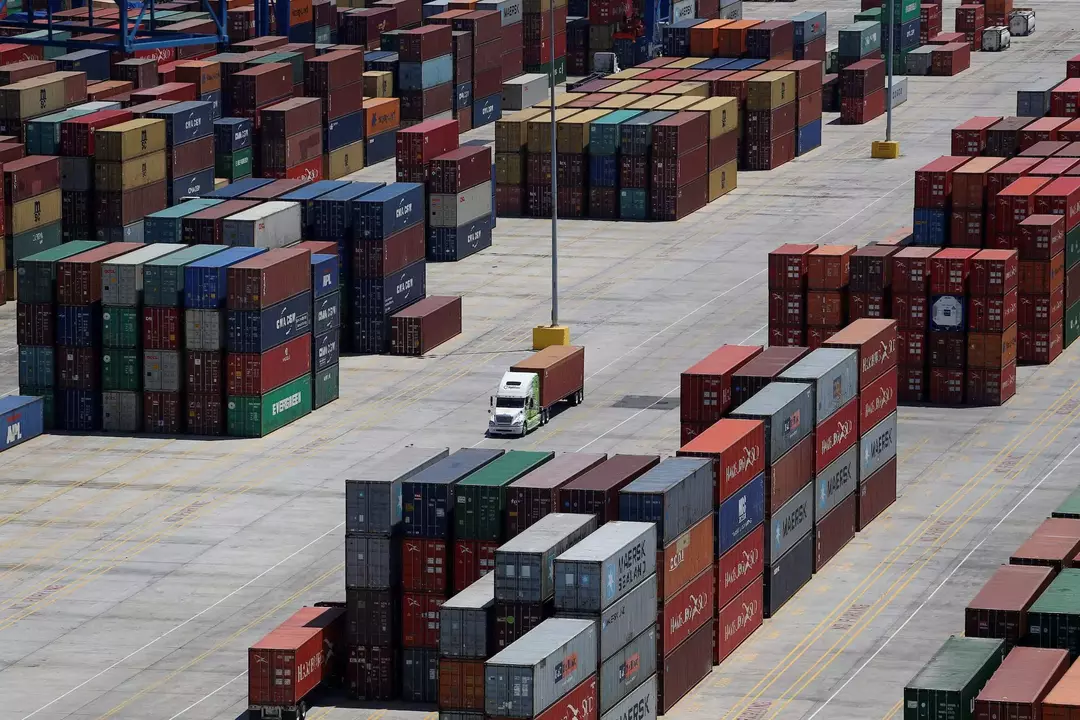

“Shipping Surge: U.S. Importers Rush to Beat China Tariffs Amid Maritime Uncertainty”

Read More:

- How Big Data and AI Are Revolutionizing the Maritime Industry

- Big Data Security in Maritime Operations: Threats in International Waters

- Trump Tariffs and Their Seismic Impact on Global Maritime Trade

- Big Data in Logistics: Exposing Russia’s Maritime Sanctions Evasion

- AI Revolution in Maritime Industry: How Artificial Intelligence is Transforming Shipping in 2025

Leave a Reply