USTR’s Proposed Restrictions on Chinese-Built Ships

Introduction to USTR’s Proposed Restrictions

The U.S. Trade Representative (USTR) has proposed significant new restrictions targeting Chinese-built ships and operators. This action follows a Section 301 investigation initiated by five major U.S. labor unions in March 2024. The investigation found that China’s maritime sector practices are “unreasonable and burdensome to U.S. commerce.”

The proposed measures include a $1.5 million flat fee per port call for any Chinese-built vessel entering U.S. ports. Additionally, tiered fees will apply based on operators’ exposure to Chinese-built vessels and newbuild orders. Operators with fleets comprising more than 50% Chinese-built vessels could face fees up to $1 million per port call. Those with less exposure would pay less. Notably, operators could be eligible for refunds up to $1 million per port call if they operate U.S.-built vessels.

These measures aim to address concerns about unfair trade practices. The fees aim to level the playing field for U.S. shipbuilders and operators. The industry has long argued that they are at a competitive disadvantage due to China’s state-supported shipbuilding industry.

The proposal has sparked debate within the shipping industry. Some argue that the fees could disrupt global supply chains and increase costs for consumers. The USTR’s proposal is currently under review. The shipping industry is closely watching the developments. The outcome could have significant implications for global trade and maritime economics. The proposed fees could reshape global shipping economics, potentially driving demand for alternative routes and modes of transport FreightWaves.

Impact on Major Ocean Carriers

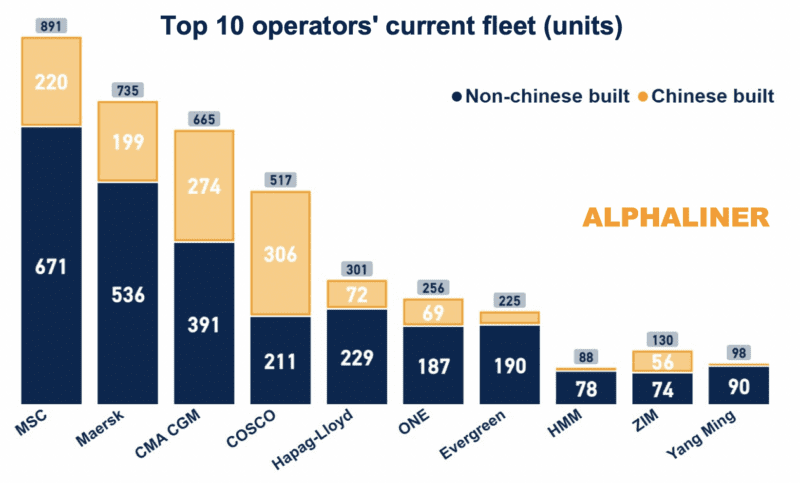

The impact on major carriers in the container sector could be substantial. Chinese-built vessels make up 32% of the global container fleet. All ten of the world’s largest ocean carriers have at least some Chinese-built vessels in their fleets. This means these carriers would face minimum fees of $500,000 per U.S. port call under the proposed fee structure.

China’s state-owned COSCO Group, including OOCL, appears most vulnerable. However, the impact extends beyond COSCO. Carriers like Maersk, MSC, CMA CGM, and others also operate Chinese-built vessels. These companies would need to decide whether to absorb the additional costs, reroute vessels to avoid U.S. ports, or pass the fees on to customers.

The proposed fees could lead to increased costs for U.S. importers and exporters. This situation might disrupt supply chains and affect trade dynamics. It could spur geopolitical tensions and potential retaliatory measures from China.

However, the proposed measures might incentivize carriers to diversify their vessel procurement strategies. They might consider buying ships from other countries to avoid such fees in the future USTR. This shift could benefit shipyards in countries like South Korea, Japan, and Singapore.

Another significant impact is the potential for legal challenges. The fees could be seen as discriminatory and inconsistent with international trade rules. This might lead to further complications in global trade relations.

Economic Implications and Trade Dynamics

The USTR’s proposed restrictions on Chinese-built ships and operators could significantly impact global shipping economics. The measures aim to address unfair trade practices and level the playing field for U.S. shipbuilders and operators. However, the fees could disrupt global supply chains and increase costs for consumers.

The shipping industry is closely watching the developments. The outcome could have significant implications for global trade and maritime economics. The proposed fees could reshape global shipping economics, potentially driving demand for alternative routes and modes of transport.

The Bottom Line

The USTR’s proposed restrictions targeting Chinese-built ships and operators include substantial port fees. These fees could reshape global shipping economics. The measures aim to address unfair trade practices and level the playing field for U.S. shipbuilders and operators. The proposal has sparked debate within the shipping industry. Some argue that the fees could disrupt global supply chains and increase costs for consumers.

The impact on major carriers in the container sector could be substantial. Chinese-built vessels make up 32% of the global container fleet. The proposed fees could lead to increased costs for U.S. importers and exporters. This situation might disrupt supply chains and affect trade dynamics. It could spur geopolitical tensions and potential retaliatory measures from China.

However, the proposed measures might incentivize carriers to diversify their vessel procurement strategies. This shift could benefit shipyards in countries like South Korea, Japan, and Singapore. Another significant impact is the potential for legal challenges. The fees could be seen as discriminatory and inconsistent with international trade rules. This might lead to further complications in global trade relations.

Leave a Reply