Russia Assembles Flotilla of LNG Carriers in Arctic Waters Ahead of EU Transshipment Ban

Russia’s Strategic Response

Russia’s strategic response to the EU’s transshipment ban on Russian LNG involves a multifaceted approach aimed at ensuring the continued flow of natural gas exports despite international sanctions. This chapter delves into the detailed analysis of Russia’s amassing of LNG carriers in Arctic waters and the strategic reasons behind this move, as well as its potential impact on global energy markets.

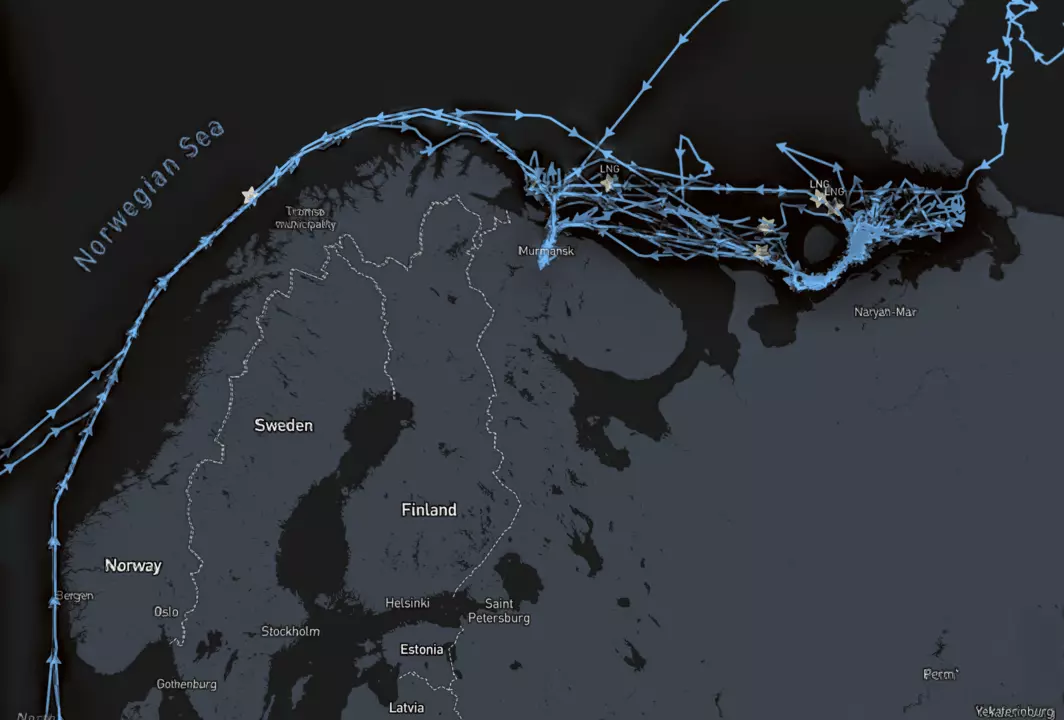

Russia’s Amassing of LNG Carriers in Arctic Waters

Russia has been actively amassing LNG carriers in Arctic waters as a strategic maneuver to circumvent the EU’s transshipment ban. This move is part of a broader effort to maintain energy exports despite the sanctions imposed by the European Union. The EU’s decision to ban the transshipment of Russian LNG through its ports, effective from March 2025, has forced Russia to explore alternative routes for exporting its natural gas (Source: S&P Global).

The amassing of LNG carriers in Arctic waters is a critical component of this strategy. These carriers are equipped to navigate the challenging Arctic conditions, which include thick ice and low temperatures. The Arctic route offers a shorter distance to Asian markets compared to traditional Southern routes, making it an attractive alternative for Russia’s energy exports (Source: The Barents Observer).

Strategic Reasons Behind the Move

The strategic reasons behind Russia’s amassing of LNG carriers in Arctic waters are multifold. Firstly, the Arctic route allows Russia to bypass the EU’s transshipment ban, which prohibits the use of EU ports for the transshipment of Russian LNG. This ban is designed to disrupt Russia’s LNG export logistics and reduce its ability to finance the war in Ukraine (Source: Oxford Energy).

Secondly, the Arctic route offers a more direct and efficient path to Asia, reducing transit times and associated costs. This efficiency is crucial for Russia, which relies heavily on energy exports to maintain its economic stability. The shorter distance also means lower operational costs, making the Arctic route a financially viable option despite the challenges posed by Arctic conditions (Source: Lloyd’s List).

Thirdly, the amassing of LNG carriers in Arctic waters is a strategic response to the EU’s broader sanctions regime. The EU has imposed a range of restrictive measures on Russia, including asset freezes and bans on certain technologies and services. By focusing on the Arctic route, Russia can minimize its reliance on EU technologies and services, thereby reducing the impact of these sanctions (Source: Oxford Energy).

Potential Impact on Global Energy Markets

Russia’s strategic move to amass LNG carriers in Arctic waters has significant implications for global energy markets. Firstly, it underscores the resilience of Russia’s energy sector in the face of international sanctions. The country’s ability to navigate around the EU’s transshipment ban demonstrates its commitment to maintaining energy exports, even in the face of adversity (Source: Financial Times).

Secondly, the Arctic route could become a significant player in global LNG trade. As Russia continues to develop its Arctic LNG projects, the demand for high-ice-class vessels is likely to increase. This could drive innovation in shipbuilding and maritime technology, as well as attract investment in Arctic infrastructure (Source: Lloyd’s List).

Thirdly, the Arctic route could have geopolitical implications. The use of Arctic waters for energy transit raises questions about sovereignty and territorial claims in the region. It also raises concerns about environmental impact and the potential for accidents in one of the world’s most remote and challenging maritime environments (Source: High North News).

The Role of the Shadow Fleet

The “shadow fleet” refers to a collection of vessels, including tankers and LNG carriers, that Russia has been using to circumvent international sanctions and maintain its energy exports, particularly to China. This fleet operates under the radar of international regulations and sanctions, making it a crucial component of Russia’s energy strategy.

Composition of the Shadow Fleet

The shadow fleet is composed of a diverse range of vessels, including:

- Tankers: These vessels transport crude oil and refined products. They are crucial for Russia’s oil exports, which have been significantly impacted by Western sanctions.

- LNG Carriers: These ships transport liquefied natural gas. The shadow fleet includes both ice-class and conventional LNG carriers, which are essential for Russia’s LNG exports, particularly from its Arctic projects like Yamal LNG and Arctic LNG 2.

- Support Vessels: These include supply vessels, tugboats, and other support vessels that are essential for the operation of the main fleet.

Operational Strategies

The shadow fleet operates through a variety of strategies to evade sanctions and maintain energy exports:

- Flag of Convenience: Many vessels in the shadow fleet fly flags of convenience, which are countries that do not impose stringent sanctions. This allows the vessels to operate under the jurisdiction of these countries, making them less susceptible to international sanctions.

- Offshore Operations: The vessels often operate in remote and less regulated areas, such as the high seas or the Arctic, where they are less likely to be intercepted or inspected by international authorities.

- Clandestine Transfers: The shadow fleet engages in clandestine transfers of energy products, often using ship-to-ship transfers or other clandestine methods to avoid detection.

- Use of Neutral Countries: Some vessels use neutral countries as transit points to avoid being intercepted by sanctions-enforcing nations.

The Role of the Shadow Fleet in Evading Sanctions

The shadow fleet plays a critical role in helping Russia evade international sanctions. By operating under the radar of international regulations, the shadow fleet allows Russia to continue its energy exports, particularly to China. This is a significant concern for the international community, as it undermines the effectiveness of sanctions aimed at curbing Russia’s energy exports.

The Impact of the EU Transshipment Ban

The EU’s transshipment ban on Russian LNG is a significant blow to Russia’s energy export strategy. The ban prohibits the transshipment of Russian LNG through EU ports to non-EU countries, effectively cutting off a major route for Russia’s LNG exports. This has forced Russia to look for alternative routes and methods to continue its LNG exports, including the use of the shadow fleet.

Arctic Operations and Yamal LNG

Yamal LNG: A Cornerstone of Russian Arctic Energy Strategy

Yamal LNG, located on the Yamal Peninsula in Western Siberia, is a monumental project led by Novatek, a Russian energy giant. This liquefied natural gas (LNG) plant, situated at Sabetta on the Ob River, marks a significant milestone in Russia’s Arctic energy strategy. The project, completed in 2017, is a testament to Russia’s ambition to leverage its vast Arctic resources for global energy markets. The facility, with a capacity of 17.4 million tons per annum, is strategically positioned to capitalize on the region’s rich gas reserves and the growing demand for LNG worldwide.

Logistics and Operational Challenges

Operating LNG carriers in Arctic waters presents unique logistical and operational challenges. The harsh environmental conditions, characterized by ice-covered waters, extreme temperatures, and limited visibility, necessitate specialized vessels and advanced navigation techniques. The Yamal LNG project employs a fleet of 15 custom-designed Russian ARC7 ice-class LNG carriers, each capable of navigating through thick ice and transporting LNG to international markets year-round. These vessels are equipped with advanced propulsion systems and ice-breaking capabilities, allowing them to operate independently without the need for icebreaker support. The 300-meter-long carriers can carry up to 172,600 cubic meters of LNG and maintain a speed of 19.5 knots in open water and 5.5 knots in 1.5-meter-thick ice, ensuring efficient and reliable transportation of LNG through the Northern Sea Route (NSR).

Navigating Ice-Covered Waters

The NSR, which stretches from the Kara Sea to the Bering Strait, is a critical route for Arctic LNG exports. However, the route is ice-covered for approximately nine months of the year, presenting significant navigational challenges. To ensure safe and efficient operations, LNG carriers must navigate through ice-covered waters with precision, utilizing advanced ice navigation systems and real-time data on ice conditions. The Yamal LNG project has invested in state-of-the-art ice navigation technologies and has established a robust network of support vessels, including icebreakers and ice-strengthened tankers, to assist in the safe transit of LNG carriers through the NSR.

Environmental Considerations

The environmental impact of Arctic LNG operations is a critical concern. The Yamal LNG project has implemented stringent environmental management practices to mitigate its ecological footprint. These measures include the use of advanced emission control technologies, regular monitoring of water quality, and the implementation of best practices for waste management. The project has also invested in research and development to enhance the environmental performance of LNG carriers and reduce their impact on Arctic ecosystems. Additionally, the Yamal LNG project has partnered with international organizations and environmental groups to promote sustainable practices and share best practices in Arctic LNG operations.

Economic and Strategic Implications

The Yamal LNG project holds significant economic and strategic implications for Russia. As the world’s largest LNG exporter, Russia aims to maintain its position in the global energy market and capitalize on the growing demand for LNG. The project is a key component of Russia’s broader strategy to diversify its energy exports and reduce dependence on traditional routes such as the Suez Canal. By leveraging the NSR, Russia can bypass Western sanctions and export LNG to key markets in Asia and Europe, further solidifying its position as a major energy player.

Sanctions and Geopolitical Implications

The U.S. and EU have imposed a series of sweeping sanctions on Russian energy exports, targeting key sectors and entities involved in the country’s energy sector. These sanctions are part of a broader strategy aimed at curbing Russia’s revenue from energy exports and undermining its military and economic capabilities.

The U.S. Department of the Treasury took significant action to fulfill the G7 commitment to reduce Russian revenues from energy. The sanctions target Gazprom Neft and Surgutneftegas, more than 180 vessels, and dozens of oil traders, oilfield service providers, insurance companies, and energy officials. This move is intended to disrupt Russia’s primary revenue source and limit its ability to fund its military operations in Ukraine (Source: U.S. Department of the Treasury).

The Biden administration’s sanctions package, adopted on January 10, represents the most severe blow to Russia’s oil sector since early 2023. The restrictions target a record number of tankers from the ‘shadow fleet’ which transport Russian oil and fuels. Additionally, several Russian energy companies were directly targeted by the sanctions. This package underscores the U.S.’s commitment to isolating Russia’s energy sector and preventing it from accessing international markets (Source: OSW).

The EU has also taken decisive action against Russia’s energy exports. With its 14th package of sanctions, the EU has sanctioned nearly half of its 2021 exports to Russia. This package includes additional import bans and prohibitions in relation to Russian LNG. The EU’s measures aim to close loopholes and hit Russia’s gas exports for the first time, further isolating the country’s energy sector from global markets (Source: European Commission).

The US has imposed sanctions on two more LNG carriers and two related shipping companies associated with Russia’s Arctic LNG export project. This move is part of a broader strategy to curb Russia’s ability to export LNG and other energy products, further limiting its revenue streams and economic capabilities (Source: S&P Global).

Additionally, the UK and the US have placed two Russian oil majors on a blacklist, as part of an ongoing sanctions spree that spreads to 183 shadow fleet vessels. This comprehensive approach aims to cut off Russia’s access to international markets and financial systems, making it more difficult for the country to fund its military operations and economic activities (Source: Offshore Energy).

The geopolitical implications of these sanctions are far-reaching. The EU’s ban on transshipment of Russian LNG through EU ports to non-EU countries has significant implications for global energy dynamics. This measure is expected to redirect Russia’s LNG shipments to countries less reliant on Russian energy, potentially shifting global energy markets and influencing energy prices (Source: Oxford Energy).

The sanctions have also sparked a strategic response from Russia, with the country accelerating its efforts to develop and deploy the ‘shadow fleet.’ This fleet consists of hundreds of tankers and other vessels designed to evade sanctions and maintain energy exports, particularly to Asia. The shadow fleet is a critical component of Russia’s energy export strategy, and its development and deployment are seen as a response to the international sanctions regime (Source: S&P Global).

Conclusions

Russia’s assembly of LNG carriers in Arctic waters represents a strategic maneuver to circumvent the EU’s transshipment ban and maintain energy exports. The use of the ‘shadow fleet’ and focus on Arctic operations signal Russia’s determination to navigate international sanctions and secure its energy future. This geopolitical move has significant implications for global energy markets and geopolitical dynamics, highlighting Russia’s adaptability and resolve in the face of international pressure.

Sources

- S&P Global – EU Ban on Russian LNG Transshipment

- The Barents Observer – Moscow’s Shadow Fleet

- Oxford Energy – EU Sanctions on Russian LNG

- Lloyd’s List – Russia’s Arctic LNG Project

- Oxford Energy – EU Sanctions on Russian LNG: Choices and Consequences

- Financial Times – Russia’s Energy Resilience

- Lloyd’s List – US Sanctions on LNG Carriers

- High North News – Russia’s Shadow Fleet

- U.S. Department of the Treasury – Sanctions on Russian Energy

- OSW – Sanctions on Russia

Leave a Reply