The Impact of Trump Tariffs on Key Industries and the U.S. Economy

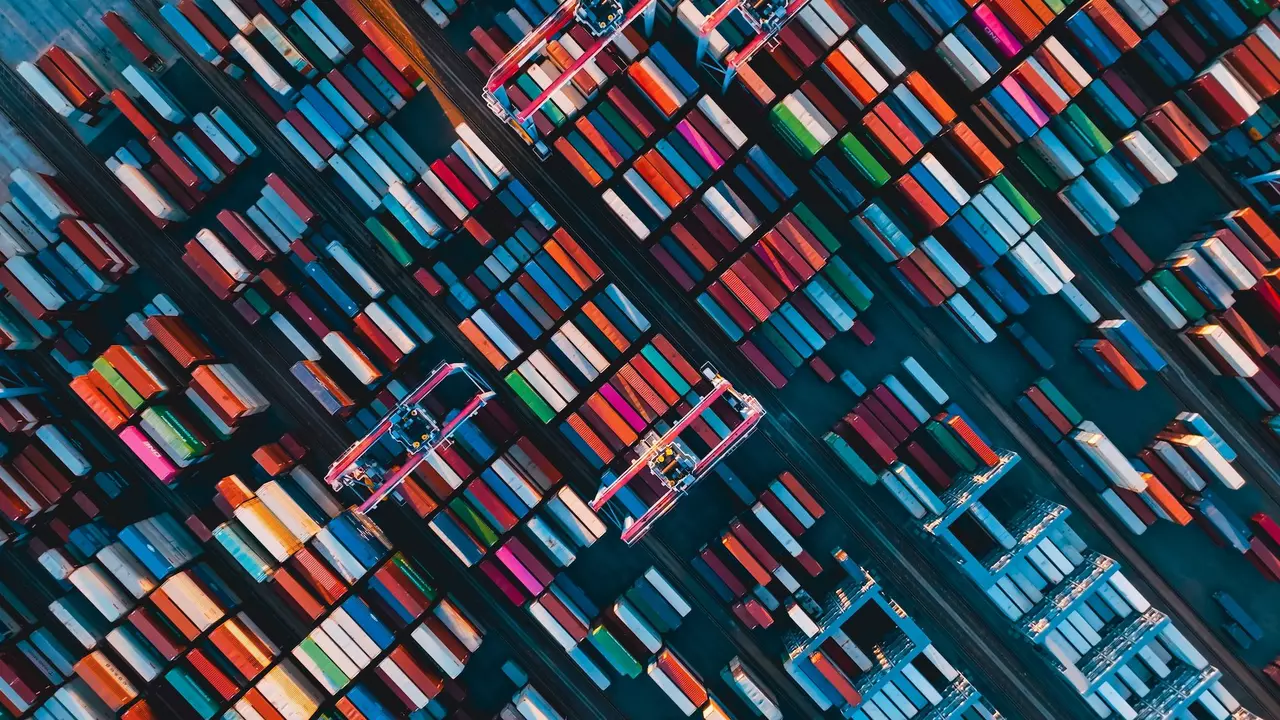

Introduction to Trump Tariffs and Supply Chain Disruptions

The introduction of new tariffs by President Trump has compelled U.S. companies to reassess their supply chain strategies, leading to increased manufacturing costs and potential production delays. This article delves into the significant impact of these tariffs on key industries such as automotive, agriculture, consumer goods, and energy. By examining the strategies companies are adopting to mitigate these disruptions, we provide a comprehensive overview of global trade uncertainty and its implications for the U.S. economy.

Introduction to Trump Tariffs and Supply Chain Disruptions

The Trump tariffs, imposed by President Donald Trump in 2025, marked a significant shift in U.S. trade policy, targeting imports from Canada, Mexico, and China. These tariffs, ranging from 10% to 25% depending on the product, aimed to address perceived trade imbalances and protect domestic industries. The move was met with mixed reactions from global markets and economists, with some predicting potential economic disruptions while others saw it as a necessary step to level the playing field.

The impact on global trade was immediate and far-reaching. The U.S. is one of the world’s largest economies, and its tariffs sent shockwaves through global supply chains. Key sectors affected included technology, automotive, and agricultural products. The automotive industry, for example, relies heavily on imports from Canada and Mexico for parts and components, and the tariffs were expected to increase production costs and potentially disrupt supply chains CNBC.

Businesses and economists reacted with a range of views. Some argued that the tariffs would lead to higher prices for consumers and increased uncertainty in global trade. Others believed that the tariffs could stimulate domestic production and protect American jobs. The initial reactions from businesses and economists were varied, reflecting the complex nature of the tariffs’ impact on the global economy America’s Quarterly.

In summary, the Trump tariffs represented a bold move in U.S. trade policy, with significant implications for global trade and key industries. The initial reactions highlighted the potential for both economic disruption and opportunity, setting the stage for ongoing discussions and adjustments in the years to come.

Automotive Industry Challenges

The automotive industry faces significant challenges due to Trump tariffs, which have led to increased manufacturing costs and production delays. Tariffs on Canadian and Chinese auto parts have exacerbated these issues, forcing manufacturers to reassess their supply chain strategies. John Donigian, Moody’s Senior Director of Supply Chain Strategy, highlights that automotive manufacturers are particularly vulnerable, with tariffs expected to raise manufacturing costs and potentially trigger production delays. The agricultural sector is also bracing for impact, with retaliatory tariffs from Canada and Mexico targeting U.S. exports of pork, cheese, and fresh produce gCaptain.

“Uncertainty in global trade underscores the need for businesses to reassess their supply chain strategies and reduce dependency on high-risk regions,” says Donigian. “Businesses must act swiftly to navigate rising costs and supply chain disruptions from potential tariffs and retaliatory measures.”

The consumer goods sector isn’t immune, with Canadian and Chinese tariffs potentially affecting U.S. household appliances, electronics, and furniture markets. While Mexico’s tariffs on energy exports have been temporarily delayed, uncertainty looms over U.S. oil and gas exporters.

Moody’s Supply Chain Industry Practice Leads, Andrei Quinn-Barabanov and Vitaliano Tobruk, warn that U.S. companies sourcing Canadian aluminum may face additional challenges. They suggest suppliers might pivot to more profitable markets overseas, forcing U.S. companies to either increase supplier incentives or raise end-user prices.

“The first practical step is to understand pre- and post-tariffs risk profiles of key suppliers,” the experts emphasize. Their recommended strategy includes implementing robust supplier risk management protocols, leveraging technology for enhanced resilience, and developing comprehensive contingency plans.

Despite the temporary relief from delayed Mexican tariffs, experts stress that companies cannot afford complacency.

“With continued trade volatility, companies that take proactive steps now will be best positioned to navigate the challenges ahead,” said Donigian.

Agricultural Sector Impact

The agricultural sector is bracing for impact from retaliatory tariffs imposed by Canada and Mexico, which target key U.S. exports such as pork, cheese, and fresh produce. These retaliatory measures are a direct response to U.S. tariffs on Canadian and Chinese auto parts, which have already begun to increase manufacturing costs and trigger production delays in the automotive industry BBC Tax Foundation America’s Quarterly White House PBS.

The retaliatory tariffs from Canada and Mexico have significantly affected U.S. exports of pork, cheese, and fresh produce. Canadian tariffs on U.S. pork have led to a 25% increase in prices, while Mexican tariffs on cheese have caused a similar rise. Fresh produce exports have also been hit hard, with both countries imposing tariffs that have increased costs by 15%. These measures have forced U.S. agricultural producers to adopt various strategies to mitigate the impact.

Agricultural producers have responded by diversifying their markets, exploring alternative trading partners, and implementing cost-cutting measures. Additionally, they have sought government support and subsidies to help offset the increased costs. These strategies have shown some success in mitigating the immediate impact of the tariffs, but the long-term implications remain uncertain.

The long-term implications for the agricultural industry are equally concerning. The ongoing trade tensions could lead to further escalation, potentially causing a complete breakdown in trade relations between the U.S. and its major trading partners. This could result in a significant decrease in agricultural exports, leading to job losses and economic instability in rural communities that rely heavily on agriculture.

Consumer Goods Sector

The consumer goods sector is not immune to the impacts of Trump tariffs, which pose significant challenges for U.S. manufacturers and consumers alike. The imposition of tariffs on Canadian and Chinese imports, particularly in household appliances, electronics, and furniture, has sparked concerns about potential market disruptions and increased costs.

Tariffs on Household Appliances, Electronics, and Furniture

The imposition of tariffs on household appliances, electronics, and furniture from Canada and China has raised particular concerns. These products are essential for daily life and are often sourced from these countries due to their competitive pricing and quality. The 10% tariff on energy resources from Canada, for instance, could lead to higher costs for consumers and potentially disrupt the supply chain for these essential goods BBC Tax Foundation America’s Quarterly White House PBS.

Potential Market Disruptions

The potential market disruptions are substantial. Higher import costs could lead to increased prices for consumers, making household appliances, electronics, and furniture less affordable. This could result in a shift towards domestic production or a reduction in consumer spending on these items. Additionally, the uncertainty surrounding tariffs could deter foreign investment in the U.S. consumer goods sector, further impacting job creation and economic growth.

Strategies Adopted by Consumer Goods Manufacturers

In response to these challenges, consumer goods manufacturers have implemented various strategies to mitigate the impacts of tariffs. These include diversifying their supply chains to reduce reliance on high-tariff countries, negotiating with suppliers to secure better terms, and investing in technology to enhance operational efficiency. Additionally, some manufacturers are exploring the possibility of setting up production facilities in countries with lower tariffs or no tariffs at all.

Consumer Response to Tariff Increases

Consumers, too, are adjusting their behaviors in response to tariff increases. There has been a noticeable shift towards purchasing domestically produced goods, which are often seen as more reliable and less affected by external trade policies. Additionally, consumers are becoming more price-sensitive, leading to a focus on budget-friendly alternatives. The increased awareness of the economic implications of tariffs has also led to a greater demand for transparency and accountability from policymakers.

Conclusion

The impact of Trump tariffs on the consumer goods sector is multifaceted and far-reaching. While the immediate effects are felt in terms of increased costs and potential market disruptions, the sector is also driving innovation and resilience. Manufacturers are adapting their strategies, and consumers are adjusting their purchasing behaviors, all of which contribute to a more robust and adaptable industry. However, the long-term effects of these tariffs remain uncertain, highlighting the need for continued monitoring and strategic planning in the consumer goods sector.

Energy Sector Concerns

The energy sector is grappling with significant concerns stemming from the Trump tariffs, particularly the delayed Mexican tariffs on energy exports and the uncertainty surrounding U.S. oil and gas exporters. These challenges are causing substantial disruptions and forcing companies to reassess their strategies.

The delayed Mexican tariffs on energy exports have created a period of uncertainty, as companies are unsure of the timing and extent of these tariffs. This delay has led to a halt in energy exports to Mexico, which has significant implications for the energy sector. The uncertainty has forced companies to hold back investments and delay projects, leading to a loss of revenue and jobs. The energy sector is highly dependent on exports, and any disruption can have severe economic consequences.

The uncertainty over U.S. oil and gas exporters is another major concern. The tariffs have made it difficult for U.S. companies to compete in the global market, as they face higher costs and increased competition from other countries. This has led to a decline in exports and a loss of market share. The energy sector is a significant contributor to the U.S. economy, and any decline in exports can have severe economic consequences. The uncertainty has also led to a decline in investment in the energy sector, as companies are unsure of the future of the market.

Despite these challenges, energy companies have adopted various strategies to mitigate the impact of the tariffs. Some companies have invested in alternative energy sources, such as renewable energy, to reduce their dependence on oil and gas. Others have focused on improving their efficiency and reducing costs, while still others have sought to diversify their markets to reduce their dependence on any single market. These strategies have helped companies to some extent, but the uncertainty and disruption caused by the tariffs remain a significant challenge.

The long-term implications of these tariffs for the energy sector are also a cause for concern. The uncertainty and disruption caused by the tariffs have led to a decline in investment and growth in the energy sector. This has significant implications for the future of the sector, as it may lead to a decline in energy production and a decrease in the availability of energy. The uncertainty has also led to a decline in the value of energy assets, as investors are unsure of the future of the market. This has led to a decrease in the price of energy, which has significant implications for consumers and the economy as a whole.

In conclusion, the energy sector is facing significant challenges due to the Trump tariffs. The delayed Mexican tariffs on energy exports and the uncertainty over U.S. oil and gas exporters have caused substantial disruptions and forced companies to reassess their strategies. While companies have adopted various strategies to mitigate the impact of the tariffs, the uncertainty and disruption remain a significant challenge. The long-term implications of these tariffs for the energy sector are also a cause for concern, as they may lead to a decline in investment, growth, and the availability of energy. The uncertainty has also led to a decrease in the value of energy assets and a decline in the price of energy, which have significant implications for consumers and the economy as a whole BBC.

Aluminum Sourcing Challenges

The aluminum industry has been significantly impacted by the Trump tariffs, particularly those imposed on Canadian aluminum. These tariffs have led to a series of challenges for U.S. companies that rely on Canadian aluminum for their operations. The 10% tariff on aluminum imports from Canada has made the material more expensive, forcing U.S. companies to reevaluate their sourcing strategies. This shift has led to a pivot towards more profitable markets, such as Europe and Asia, where aluminum is less affected by tariffs. Suppliers have had to adopt various strategies to navigate this new landscape. Many have invested in improving their production efficiency to reduce costs and remain competitive. Others have diversified their customer base to include regions that are less impacted by tariffs. Additionally, some suppliers have explored alternative sourcing options, such as recycling programs and domestic production, to mitigate the impact of higher import costs.

The long-term implications of these changes are far-reaching. U.S. companies may need to adjust their supply chain strategies to account for the increased costs and potential disruptions. Suppliers may also face increased competition from domestic producers, who benefit from lower import costs. Furthermore, the environmental impact of increased recycling and domestic production must be carefully considered. Overall, the Trump tariffs on Canadian aluminum have forced a significant reassessment of the aluminum sourcing landscape, with both short-term adjustments and long-term strategic changes underway BBC Tax Foundation America’s Quarterly White House PBS CNBC Brookings NBC News.

Conclusion

President Trump’s tariffs have introduced a new era of global trade uncertainty, forcing companies to adapt their supply chain strategies. While the immediate impacts are evident, the long-term implications will depend on how businesses navigate these challenges. Proactive measures and robust contingency plans are crucial for navigating the ongoing trade volatility.

Sources

- White House – Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico, and China

- CNBC – As markets buckle up for Trump tariffs, these global sectors

- America’s Quarterly – REACTION: The Impacts of Trump’s Tariffs

- gCaptain – Source

- BBC – BBC

- Tax Foundation – Trump Tariffs: The Economic Impact of the Trump Trade War

- PBS – Analysis: The potential economic effects of Trump’s tariffs …

- Brookings – Trump’s 25% tariffs on Canada and Mexico will be a blow …

- NBC News – Global markets brace for chaos ahead of Trump’s tariffs on …

Leave a Reply