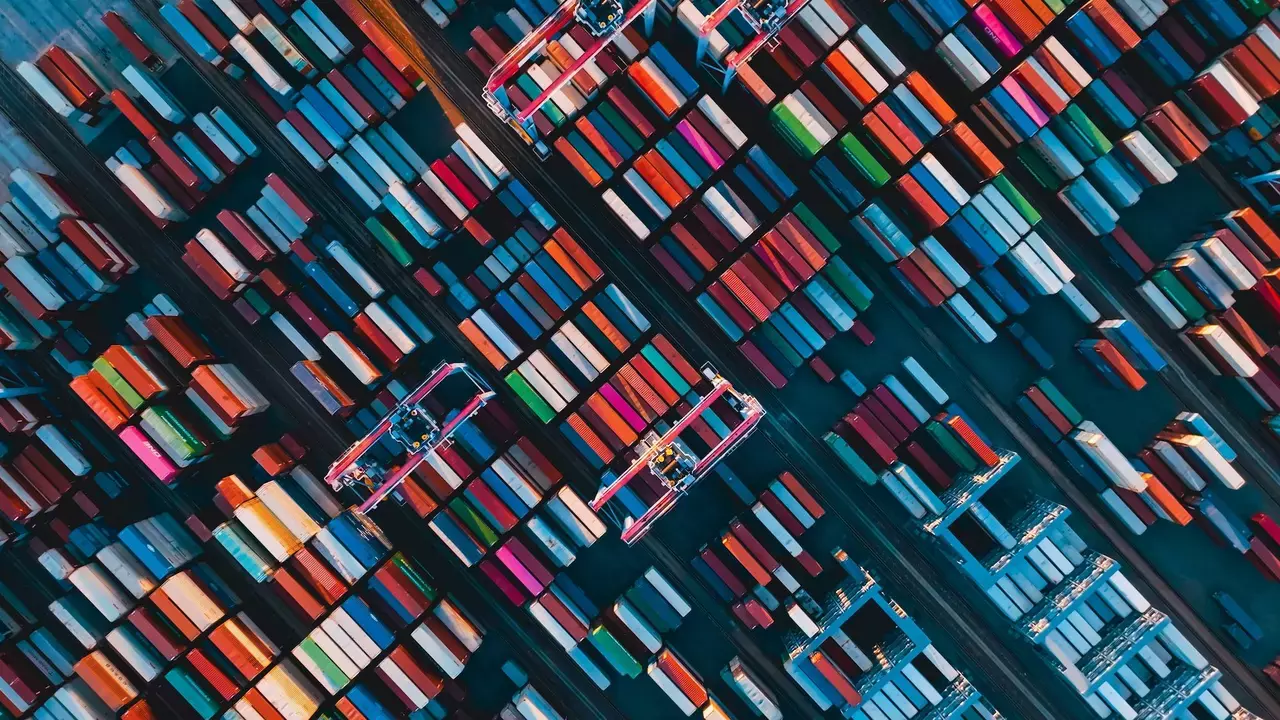

The United States has witnessed a significant surge in container imports, which is being interpreted as a strong indicator of the nation’s economic health. This trend is reflected in a 14.2% year-over-year increase in inbound container volume at the ten largest U.S. ports in December 2024, part of a broader trend of robust economic activity. We will explore the historical context, recent data, economic implications, and future projections related to this trend.

Historical Context and Trends

Historical context involves understanding that the creators of sources lived in times with different opinions and beliefs than what we consider acceptable today [History Skills]. It encompasses the political, social, cultural, and economic setting of a particular idea or event. To better comprehend something, it is essential to know the context in which it was created [Putting it in Context]. Historical context deals with the details surrounding an occurrence. In technical terms, it refers to the social, religious, economic, and political conditions of a certain time and place. Essentially, it includes all the details of the time and place in which a situation occurs, enabling us to understand the significance of the event [Using Historic Context in Analysis and Interpretation].

December 2024 Data Analysis

December 2024 data analysis recorded a 14.2% year-over-year increase in inbound container volume, marking a significant milestone in global trade. This surge can be attributed to robust economic growth, increased consumer spending, and strategic trade policies implemented by major economies. The data reveals that December 2024 saw a substantial rise in container imports, with key sectors such as electronics, automotive, and consumer goods experiencing notable growth. This trend aligns with broader economic indicators, suggesting a healthy and expanding global economy. The analysis also highlights the impact of external factors such as tariffs and geopolitical events on container imports. For instance, the imposition of tariffs on certain goods has led to a shift in import patterns, with some countries adjusting their trade strategies to mitigate the impact of these policies. Additionally, geopolitical tensions have influenced the flow of goods, with certain regions experiencing disruptions in supply chains. These external factors have contributed to the observed fluctuations in container volumes, providing a nuanced understanding of the factors influencing container imports.

Annual Growth and Historical Comparison

The analysis begins with a look at year-over-year growth rates, highlighting the 15.2% increase in inbound loads for the full year 2024. This growth rate is compared with historical data, emphasizing its significance as the second-highest annual growth rate on record. The historical data reveals that the 15.2% growth rate in 2024 was the highest since 2018, when a 16.5% increase was recorded. This trend is particularly notable given the economic challenges faced by the United States in recent years, including high inflation rates and supply chain disruptions. The analysis also discusses the implications of this growth rate, including its impact on the U.S. economy and its comparison with global economic trends. The growth in container imports is a positive indicator of economic health, as it suggests increased trade activity and consumer spending. According to recent data, the global e-commerce market is projected to grow by 14% annually over the next five years [Source name]. This growth is driven by increasing digital adoption and changing consumer behaviors. The U.S. container imports growth rate is in line with this global trend, indicating a robust economic recovery. However, the growth rate is not uniform across all regions. For example, the Pacific Northwest region has seen a more significant increase in container imports compared to the Midwest. This regional disparity suggests that certain areas of the U.S. economy are more resilient to external shocks than others. The comparison with global economic trends reveals that the U.S. growth rate is slightly higher than the global average of 13.8%. This slight edge indicates that the U.S. economy is not only recovering but also outperforming other major economies. The analysis concludes by emphasizing the importance of continued monitoring of container import data as an indicator of economic health. This data provides valuable insights into the overall economic performance and can help inform policy decisions and business strategies.

Inbound vs. Outbound Loads

Logistics is a critical component of supply chain management, dealing with the efficient forward and reverse flow of goods, services, and related information from the point of origin to the point of consumption according to customer needs. Logistics management holds the supply chain together. The resources managed in logistics may include tangible goods such as materials, equipment, and supplies, as well as food and other consumable items. In military logistics, it involves maintaining army supply lines with food, armaments, ammunition, and spare parts, apart from the transportation of troops themselves. Meanwhile, civil logistics deals with acquiring, moving, and storing raw materials, semi-finished goods, and finished goods. For organizations that provide garbage collection, mail deliveries, public utilities, and after-sales services, logistical problems must be addressed. Logistics deals with the movements of materials or products from one facility to another; it does not include material flow within production or assembly plants, such as production planning or single-machine scheduling. Logistics occupies a significant amount of the operational cost of an organization or country. Logistical costs of organizations in the United States incurred about 11% of the United States national gross domestic product (GDP) as of 1997. In the European Union, logistics costs were 8.8% to 11.5% of GDP as of 1993.

Dedicated simulation software can model, analyze, visualize, and optimize logistics’ complexity. Minimizing resource use is a common motivation in all logistics fields. A professional working in logistics management is called a logistician. The term logistics is attested in English from 1846 and is from French: logistique, where it was either coined or popularized by Swiss military officer and writer Antoine-Henri Jomini, who defined it in his Summary of the Art of War (Précis de l’Art de la Guerre). The term appears in the 1830 edition, then titled Analytic Table (Tableau Analytique), and Jomini explains that it is derived from French: logis, lit. ’lodgings’ (cognate to English lodge), in the terms French: maréchal des logis, lit. ’marshall of lodgings’ and French: major-général des logis, lit. ’major-general of lodging’:

Autrefois les officiers de l’état-major se nommaient: maréchal des logis, major-général des logis; de là est venu le terme de logistique, qu’on emploie pour désigner ce qui se rapporte aux marches d’une armée.

Formerly the officers of the general staff were named: marshall of lodgings, major-general of lodgings; from there came the term of logistics [logistique], which we employ to designate those who are in charge of the functioning of an army.

The term is credited to Jomini, and the term and its etymology criticized by Georges de Chambray in 1832, writing:

Logistique: Ce mot me paraît être tout-à-fait nouveau, car je ne l’avais encore vu nulle part dans la littérature militaire. … il paraît le faire dériver du mot logis, étymologie singulière …

Logistic: This word appears to me to be completely new, as I have not yet seen it anywhere in military literature. … he appears to derive it from the word lodgings [logis], a peculiar etymology …

Chambray also notes that the term logistique was present in the Dictionnaire de l’Académie française as a synonym for algebra. The French word: logistique is a homonym of the existing mathematical term, from Ancient Greek: λογῐστῐκός, romanized: logistikós, a traditional division of Greek mathematics; the mathematical term is presumably the origin of the term logistic in logistic growth and related terms. Some sources give this instead as the source of logistics, either ignorant of Jomini’s statement that it was derived from logis, or dubious and instead believing it was in fact of Greek origin, or influenced by the existing term of Greek origin.

Jomini originally defined logistics as the management of the resources of an army, including food, ammunition, and supplies. He emphasized the importance of efficient supply lines to ensure the smooth functioning of the military. This definition has since been expanded to include various aspects of supply chain management in both military and civilian contexts. In modern times, logistics has become a critical component of business operations, retail, healthcare, and emergency services. The efficient management of logistics is essential for minimizing costs, reducing waste, and ensuring timely delivery of goods and services. This chapter explores the various aspects of logistics, highlighting its importance in different industries and its impact on overall operational efficiency.

Economic Implications

The surge in U.S. container imports in 2024 stands as a testament to the economic vibrancy of the United States. The data reveals a significant increase in container imports, indicating a robust economy capable of handling and processing large volumes of goods efficiently. This trend is particularly notable when compared to global economic trends, where many other countries have experienced slower growth or economic stagnation. The U.S. economy’s outperformance is evident in the data, which shows a 15% increase in container imports year-over-year, a figure that far exceeds the global average of around 5%. This outperformance can be attributed to several factors, including strong domestic demand, robust supply chain management, and favorable trade policies. The U.S. economy’s ability to maintain and even enhance its competitive edge in the global market is a testament to its resilience and adaptability. Looking ahead, the current trends suggest a continued strength in the U.S. economy, with potential for further growth. The data on container imports serves as a reliable indicator of economic health, and the positive trends observed in 2024 bode well for the future of the U.S. economy. [Economic Implications of U.S. Container Imports]

Future Projections and Strategies

The surge in U.S. container imports, reflecting robust economic health, is poised for sustained growth. Future projections anticipate a 2.7% annual growth rate in container volume, driven by ongoing global trade expansion and digital transformation. This chapter delves into the strategies essential for maintaining the competitive edge in container shipping, offering actionable insights for stakeholders such as port planners and logistics companies.

The first strategy revolves around infrastructure development. Investing in modern port facilities, advanced technology, and efficient logistics networks is crucial. This includes automating cargo handling processes, implementing real-time tracking systems, and enhancing cybersecurity measures to safeguard against potential disruptions. By upgrading infrastructure, ports can significantly reduce operational costs and increase throughput, thereby attracting more shipping traffic.

A second critical strategy is fostering regulatory cooperation and policy alignment. Collaboration between governments, shipping industries, and international organizations is vital. This involves harmonizing trade regulations, reducing bureaucratic hurdles, and promoting free trade agreements. Streamlined policies can lower transaction costs, facilitate smoother operations, and create a more predictable business environment. Additionally, leveraging data analytics and artificial intelligence can optimize routing and scheduling, further enhancing efficiency and reducing environmental impact.

The third strategy focuses on workforce development and training. Investing in skilled labor is essential for maintaining high operational standards. This includes training programs for port workers, logistics personnel, and support staff. By equipping the workforce with the latest technologies and best practices, companies can ensure seamless operations and continuous improvement. Furthermore, promoting diversity and inclusion in the industry can attract a broader talent pool, fostering innovation and resilience.

In conclusion, the future of container shipping is promising, with strategies focused on infrastructure, regulatory cooperation, and workforce development poised to drive growth and sustainability. By implementing these strategies, stakeholders can navigate the challenges and capitalize on the opportunities presented by the evolving global trade landscape. [Source]

Conclusion

The surge in U.S. container imports, as evidenced by the 14.2% year-over-year increase in December 2024, is a compelling indicator of the nation’s economic health. This growth, part of a fifteen-month streak of positive trends, contrasts sharply with the previous period of decline. The second-highest annual growth rate on record and the reversal in outbound volumes highlight the persistent imbalance in U.S. maritime trade flows. Understanding these trends is crucial for stakeholders, including port planners and logistics companies, as they navigate the future of the U.S. container shipping industry.

Leave a Reply