The U.S. LNG Industry: Economic Impact, Geopolitical Significance, and Future Prospects

The U.S. LNG industry has emerged as a critical contributor to the U.S. economy, with significant impacts on GDP, job creation, and tax revenues. The industry’s growth is expected to add $1.3 trillion to the U.S. economy through 2040, supporting nearly 500,000 new jobs and contributing $166 billion in tax revenues. This growth is driven by the U.S. becoming the world’s leading supplier of LNG, with exports supporting over 270,000 jobs annually and generating over $400 billion in GDP since exports began in 2016.

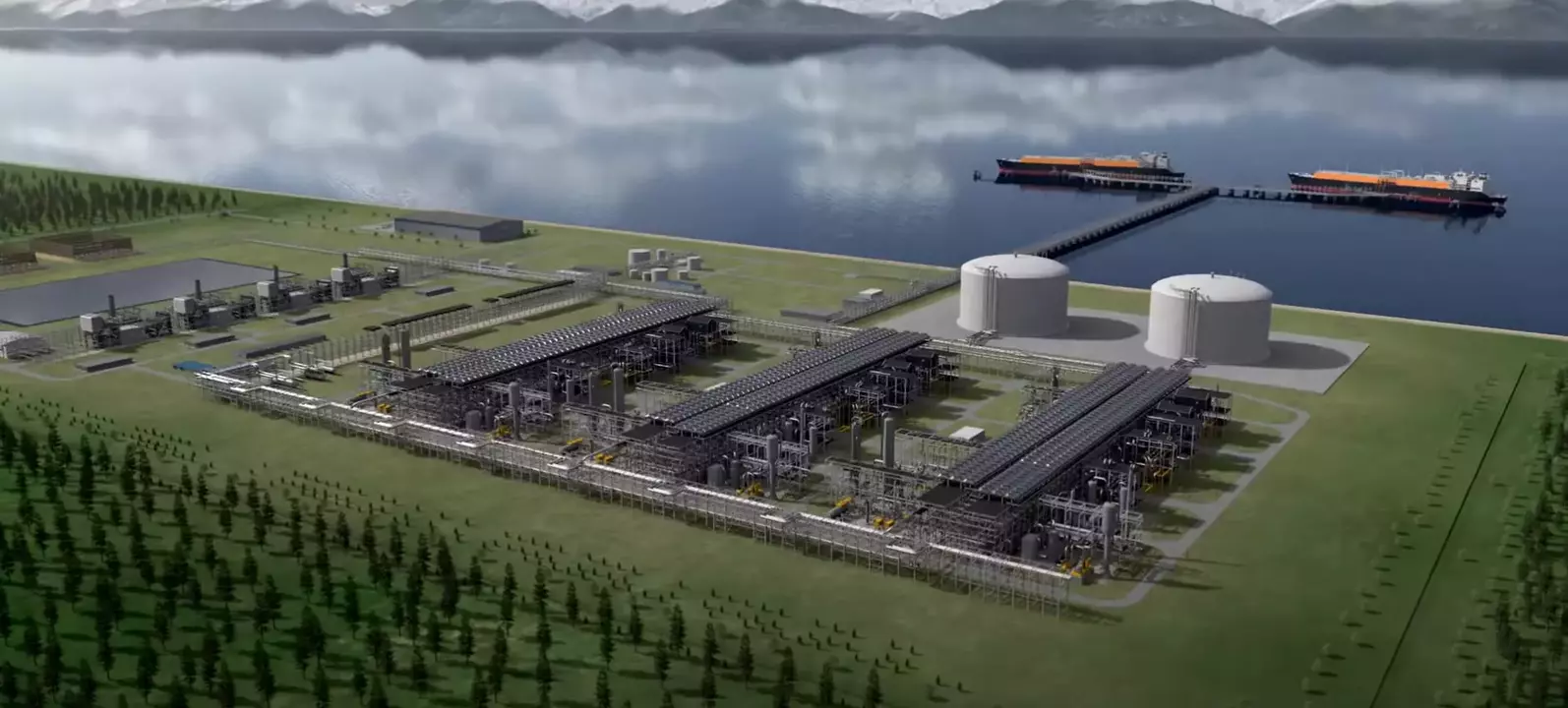

Overview of U.S. LNG Industry

The U.S. LNG industry has become a cornerstone of the nation’s energy sector, contributing significantly to the economy, job creation, and tax revenues. The industry’s growth has been driven by technological advancements, supportive policies, and increasing global demand for natural gas. This chapter provides an in-depth analysis of the economic impact of the U.S. LNG industry, focusing on its contributions to GDP, job creation, and tax revenues, as well as its broader economic multiplier effects.

Historical GDP Contributions

The U.S. LNG industry has made substantial contributions to the nation’s GDP over the past decade. According to a study by S&P Global, the industry has rapidly become an integral part of the U.S. economy, with significant investments in infrastructure and export facilities. The development of LNG export terminals, such as those in Sabine Pass and Corpus Christi, has spurred economic activity in regions that were previously reliant on declining industries.

Projected GDP Contributions Through 2040

Looking ahead, the U.S. LNG industry is expected to continue its growth trajectory, contributing even more to the nation’s GDP. The Center for Strategic and International Studies (CSIS) projects that LNG exports will play a crucial role in the U.S. energy sector, with the potential to add billions of dollars to the GDP by 2040. This growth is driven by the increasing global demand for cleaner energy sources and the U.S.’s ability to supply LNG at competitive prices.

Direct, Indirect, and Induced Jobs Supported

The U.S. LNG industry supports a wide range of jobs, from direct employment in LNG production and export facilities to indirect jobs in related industries such as construction, transportation, and manufacturing. According to a report by Williams Companies, the industry could support between 2 million to 3.9 million job-years, depending on the scale of LNG production and export activities. These jobs not only provide economic stability for workers but also contribute to the overall economic health of the regions where LNG facilities are located.

Economic Multiplier Effects

The economic impact of the U.S. LNG industry extends beyond direct contributions to GDP and job creation. The industry generates significant economic multiplier effects, as the income earned by workers and businesses in the LNG sector is spent on goods and services, further stimulating economic activity. A study by The U.S. Chamber of Commerce highlights that every dollar invested in the LNG industry generates additional economic activity, creating a ripple effect that benefits various sectors of the economy.

Contributions to Federal and State Tax Revenues

The U.S. LNG industry also contributes significantly to federal and state tax revenues. The construction and operation of LNG export terminals generate substantial tax income, which can be used to fund public services and infrastructure projects. According to Statista, the industry’s tax contributions are expected to grow as LNG exports increase, providing a stable source of revenue for governments at all levels.

Impact on the U.S. Trade Balance

The U.S. LNG industry has a positive impact on the nation’s trade balance, as LNG exports help reduce the trade deficit by generating revenue from international markets. The CSIS notes that LNG exports have become a key component of U.S. trade strategy, providing a reliable source of income and enhancing the nation’s energy security. By exporting LNG, the U.S. not only strengthens its economic position but also supports global energy markets by providing a cleaner alternative to coal and oil.

Economic Impact of U.S. LNG Industry

The U.S. LNG industry has become a cornerstone of the American economy, contributing significantly to GDP, job creation, and tax revenues. The industry’s economic impact is multifaceted, encompassing direct, indirect, and induced effects that ripple through the economy. This chapter explores these contributions in detail, providing a comprehensive view of how the U.S. LNG industry supports economic growth and stability.

Historically, the U.S. LNG industry has made substantial contributions to the nation’s GDP. According to a study by S&P Global, the industry has rapidly become an integral part of the U.S. economy, with significant growth in exports since the first export terminal opened in 2016. The cumulative economic impact from LNG plants is projected to range from $716 billion to $1.267 trillion, supporting between 2 million to 3.9 million job-years [Williams].

Looking ahead, the U.S. LNG industry is expected to continue its robust growth through 2040. Projections indicate that the industry will contribute significantly to GDP, driven by increasing global demand for natural gas. The Center for Strategic and International Studies (CSIS) highlights that U.S. LNG exports have already had an enormous impact on global gas trade, and this trend is expected to continue as more export terminals come online.

Job creation is another critical area where the U.S. LNG industry has made a substantial impact. The industry supports a wide range of jobs, from direct employment in LNG plants to indirect jobs in related sectors such as transportation and manufacturing. The National Association of Manufacturers (NAM) emphasizes that LNG exports are vital for U.S. economic growth, fostering job creation and incentivizing investments in production. The economic multiplier effects of the industry further amplify these benefits, as each job in the LNG sector supports additional jobs in the broader economy.

In terms of tax revenues, the U.S. LNG industry contributes significantly to both federal and state coffers. The industry’s growth has led to increased tax revenues, which can be used to fund public services and infrastructure projects. According to Statista, the United States is the largest liquefied natural gas supplier in the world, and the tax revenues generated from this industry are a crucial source of funding for government operations.

The U.S. LNG industry also plays a pivotal role in improving the nation’s trade balance. By exporting LNG, the U.S. reduces its trade deficit and strengthens its position in the global market. The U.S. Chamber of Commerce notes that LNG exports provide affordable energy at home and to allies abroad, enhancing the U.S.’s economic and geopolitical influence.

Geopolitical and Environmental Considerations

The U.S. LNG industry has significant geopolitical and environmental implications, shaping global energy markets and influencing U.S. energy independence. The industry has become a cornerstone of U.S. energy strategy, enabling the country to reduce its reliance on foreign energy sources and strengthen its position as a global energy leader. The export of liquefied natural gas (LNG) has not only bolstered the U.S. economy but also created strategic partnerships and alliances that enhance global energy security.

One of the most notable geopolitical impacts of the U.S. LNG industry is its role in reducing Europe’s dependence on Russian natural gas. Following Russia’s invasion of Ukraine in 2022, the U.S. significantly increased LNG exports to Europe, providing an alternative energy source and reducing the geopolitical leverage of Russia. According to the Center for Strategic and International Studies, U.S. LNG exports have helped diversify Europe’s energy portfolio, making it less vulnerable to supply disruptions. This shift has also strengthened U.S.-Europe relations, as European countries increasingly view the U.S. as a reliable energy partner.

In addition to Europe, the U.S. LNG industry has forged strategic partnerships in Asia, particularly with Japan and South Korea. These countries, which are among the largest importers of LNG, have signed long-term contracts with U.S. LNG producers, ensuring a stable supply of energy. The U.S. LNG Impact Study highlights that these partnerships not only enhance energy security but also foster economic cooperation and technological exchange between the U.S. and its Asian allies.

However, the environmental impact of the U.S. LNG industry cannot be overlooked. The production and export of LNG involve significant carbon emissions, primarily from the liquefaction process and transportation. According to the American Security Project, the carbon footprint of LNG is a growing concern, especially as the world moves towards decarbonization. The industry has been criticized for its contribution to greenhouse gas emissions, which could undermine global efforts to combat climate change.

To address these concerns, the U.S. LNG industry has begun to adopt emissions reduction technologies and practices. For instance, some LNG facilities are implementing carbon capture and storage (CCS) technologies to reduce emissions during the liquefaction process. Additionally, the industry is exploring the use of renewable energy sources to power LNG plants, thereby reducing their reliance on fossil fuels. The Williams Companies report that these efforts are part of a broader strategy to align the LNG industry with global decarbonization goals.

Despite these efforts, the environmental impact of LNG remains a contentious issue. Critics argue that the industry’s focus on expanding production and exports is incompatible with the urgent need to reduce global carbon emissions. The Sasakawa Peace Foundation notes that while LNG is often touted as a cleaner alternative to coal, its environmental benefits are limited, especially when considering the full lifecycle emissions of LNG production and transportation.

Case Studies and Success Stories

The U.S. LNG industry has seen remarkable growth over the past decade, with several notable projects that have significantly contributed to the nation’s energy landscape. Among these, the Sabine Pass LNG terminal in Louisiana stands out as a pioneering project. Operated by Cheniere Energy, Sabine Pass became the first major LNG export terminal in the lower 48 states, marking a turning point in the U.S. energy sector. The terminal’s success has been attributed to its strategic location, advanced technology, and efficient supply chain management. According to Cheniere Energy, the terminal has the capacity to export up to 30 million tonnes of LNG annually, making it one of the largest LNG export facilities in the world.

Another significant project is the Cove Point LNG terminal in Maryland, operated by Dominion Energy. This facility, which began operations in 2018, has been instrumental in supplying LNG to both domestic and international markets. The Cove Point terminal is notable for its innovative use of liquefaction technology, which has significantly reduced the energy required for the liquefaction process. This has not only improved the terminal’s efficiency but also reduced its environmental footprint. Dominion Energy reports that the terminal has the capacity to export approximately 5.25 million tonnes of LNG annually, contributing significantly to the U.S. LNG export capacity.

The development of these projects has not been without challenges. One of the primary hurdles faced by LNG developers is the lengthy and complex regulatory approval process. The Federal Energy Regulatory Commission (FERC) and the Department of Energy (DOE) play crucial roles in the approval and oversight of LNG projects. Developers must navigate a maze of environmental, safety, and economic regulations, which can delay project timelines and increase costs. However, the industry has shown resilience and adaptability, often finding innovative solutions to overcome these challenges. For instance, the use of modular construction techniques has allowed developers to reduce construction times and costs, as seen in the Corpus Christi LNG project in Texas.

Innovation has been a key driver of efficiency gains in the LNG supply chain. The adoption of advanced liquefaction technologies, such as the use of mixed refrigerant cycles, has significantly improved the energy efficiency of LNG plants. Additionally, the development of floating LNG (FLNG) facilities has opened up new possibilities for offshore gas production and liquefaction. These floating facilities can be deployed in remote locations, reducing the need for extensive pipeline infrastructure and enabling the monetization of stranded gas reserves. The Prelude FLNG facility, operated by Shell, is a prime example of this innovation. Although not a U.S. project, Prelude has set a benchmark for the industry, demonstrating the potential of FLNG technology.

Lessons learned from these projects have informed best practices for the industry. One key takeaway is the importance of stakeholder engagement. Successful LNG projects often involve close collaboration with local communities, regulators, and other stakeholders to address concerns and build support. Another lesson is the value of investing in research and development to drive technological advancements. The U.S. Department of Energy’s support for LNG research has been instrumental in fostering innovation and improving the competitiveness of U.S. LNG in the global market.

Future Prospects and Challenges

The U.S. LNG industry has experienced significant growth over the past decade, becoming a cornerstone of the global energy market. This chapter explores the future prospects and challenges facing the industry, focusing on potential areas for further expansion, long-term trends, and market projections. Additionally, it examines the regulatory and political risks, environmental and social impacts, and strategies for sustainable growth.

The outlook for U.S. LNG industry growth remains robust, with projections indicating continued expansion through 2040. According to a study by S&P Global, the industry is expected to contribute significantly to the U.S. economy, with cumulative economic impacts ranging from $716 billion to $1.267 trillion. This growth is driven by increasing global demand for natural gas, particularly in Asia and Europe, where LNG serves as a cleaner alternative to coal and oil.

Potential for further expansion and new projects is substantial, with several new LNG export terminals under development. The U.S. is poised to maintain its position as the world’s largest LNG exporter, with new projects expected to come online in the coming years. These projects will not only enhance the U.S.’s export capacity but also create thousands of jobs and generate significant tax revenues.

Long-term trends and market projections suggest that the U.S. LNG industry will continue to play a pivotal role in the global energy transition. The shift towards cleaner energy sources, coupled with geopolitical factors, has positioned U.S. LNG as a strategic asset. As noted by the Center for Strategic and International Studies, U.S. LNG exports help diversify global energy supplies and reduce reliance on less stable regions.

However, the industry faces several regulatory and political risks. The Biden Administration’s pause on new LNG export approvals has raised concerns about the future of the industry. Regulatory hurdles, including environmental reviews and permitting delays, could slow down project development and impact the U.S.’s ability to meet global demand.

Environmental and social impacts are also critical considerations. While LNG is cleaner than coal and oil, it is still a fossil fuel and contributes to greenhouse gas emissions. The industry must address these concerns through the adoption of cleaner technologies and sustainable practices. Social impacts, including community displacement and environmental justice issues, must also be carefully managed to ensure equitable development.

Strategies for sustainable growth are essential to the long-term success of the U.S. LNG industry. This includes investing in carbon capture and storage (CCS) technologies, improving energy efficiency, and exploring renewable energy integration. The industry must also engage with stakeholders, including local communities and environmental groups, to build trust and ensure that growth is both economically and environmentally sustainable.

Conclusion

The U.S. LNG industry’s growth is a testament to its economic and geopolitical significance. However, it also presents environmental challenges that must be addressed to ensure sustainable development. Continued support and innovation are crucial for balancing economic growth with environmental sustainability.

Sources

- S&P Global – Major New U.S. Industry at a Crossroads: U.S. LNG Impact Study Phase 1

- Center for Strategic and International Studies (CSIS) – U.S. LNG Export Boom: Defining National Interests

- Read More:

- Big Data in Logistics: Transforming Maritime Supply Chains in 2025

- How Big Data and AI Are Revolutionizing the Maritime Industry

- Big Data Security in Maritime Operations: Threats in International Waters

- Trump Tariffs and Their Seismic Impact on Global Maritime Trade

- Big Data in Logistics: Exposing Russia’s Maritime Sanctions Evasion

Comments

Leave a Reply